- Amazon

- eBay

- Aluminum Foil

- Food Storage Bags

- Plastic Wrap

- Bowls

- Plates

- Box Tissues

- Cabinet & Drawer Organization

- Dish Racks

- Egg Baskets

- Cabinet Door Organizers

- Carpet Cleaners

- Drain Openers

- Floor Cleaners

- Kitchen Cleaners

- Carpet Spot Cleaning Sprays

- Dimmer Switches

- Disposable Food Storage

- Disposable Plates - Bowls & Cutlery

- Electrical Boxes

- Home Automation Devices

- Multi-Outlets

- Outlet Boxes

- Switches & Dimmers

- Testers

- Facial Tissues

- Personal Cleansing Wipes

- Toilet Paper

- Garlic Presses

- Hubs & Controllers

- Laundry

- Paper & Plastic

- Tissues - Toilet Paper & Sprays

- Lunch Bags

- Multi Testers

- Pantry

- Sport Sandals & Slides

- Stain Removers

- Travel & To-Go Food Containers

- Wall Switches

- Amazon

- eBay

- Aluminum Foil

- Food Storage Bags

- Plastic Wrap

- Bowls

- Plates

- Box Tissues

- Cabinet & Drawer Organization

- Dish Racks

- Egg Baskets

- Cabinet Door Organizers

- Carpet Cleaners

- Drain Openers

- Floor Cleaners

- Kitchen Cleaners

- Carpet Spot Cleaning Sprays

- Dimmer Switches

- Disposable Food Storage

- Disposable Plates - Bowls & Cutlery

- Electrical Boxes

- Home Automation Devices

- Multi-Outlets

- Outlet Boxes

- Switches & Dimmers

- Testers

- Facial Tissues

- Personal Cleansing Wipes

- Toilet Paper

- Garlic Presses

- Hubs & Controllers

- Laundry

- Paper & Plastic

- Tissues - Toilet Paper & Sprays

- Lunch Bags

- Multi Testers

- Pantry

- Sport Sandals & Slides

- Stain Removers

- Travel & To-Go Food Containers

- Wall Switches

Top Israeli Insurtech Companies Transforming US Insurance Industry

Israeli insurtech companies have emerged as global leaders in insurance innovation, making significant waves in the United States market. These Israel-based insurance technology firms are leveraging cutting-edge technologies like artificial intelligence (AI), big data analytics, and user-friendly digital platforms to revolutionize the traditional insurance landscape.

The Rise of Israeli Insurtech in the USA: Innovation Meets Opportunity

Israel, often dubbed the “Startup Nation,” has become a hotbed for technological advancement in various sectors, including insurance. The combination of a strong entrepreneurial spirit, advanced technological expertise, and a problem-solving mindset has positioned Israeli insurtech companies at the forefront of innovation.

Why Israeli Insurtech is Thriving

- Innovative Approaches: Israeli companies excel in applying AI, machine learning, and big data to create scalable insurance solutions.

- Agile Development: The startup culture in Israel fosters rapid iteration and adaptation to market needs.

- Market Opportunity: The US insurance industry, with its size and need for modernization, provides an ideal testing ground for innovative insurtech solutions.

Top 5 Israeli Insurtech Companies Making an Impact in the US Market

1. Lemonade: Revolutionizing Home and Renters Insurance

- Key Features:

- Lightning-fast 90-second sign-up process

- Transparent pricing model

- Social impact focus with leftover premiums donated to charities

Lemonade has disrupted the traditional insurance model since its launch in 2016. This AI-driven insurtech company has reimagined the insurance experience from the ground up. Lemonade’s innovative approach has earned it a loyal customer base and a successful IPO in 2020, marking a significant milestone for the insurtech industry.

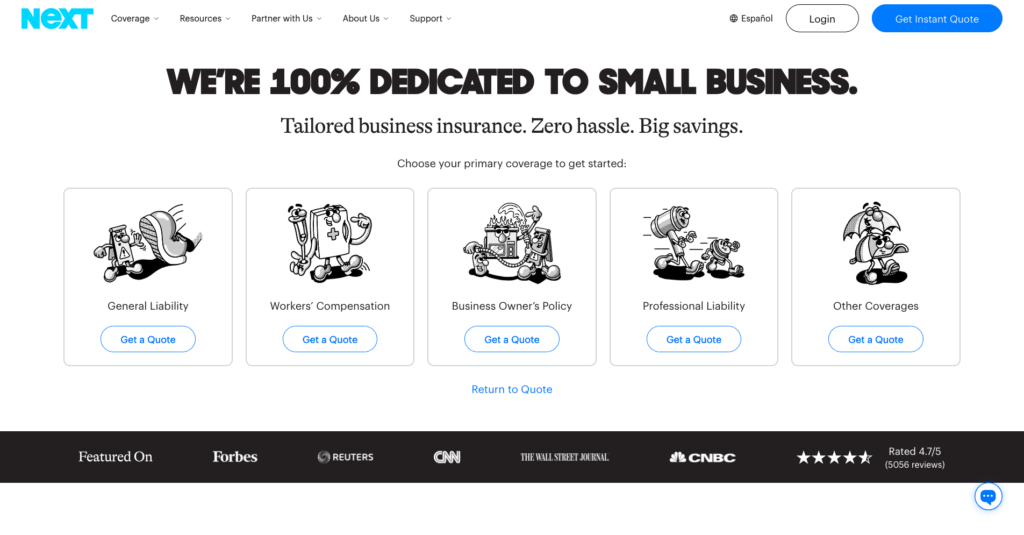

2. Next Insurance: Tailored Solutions for Small Businesses

- Key Features:

- Fully digital platform for instant quotes and policy management

- Customized insurance packages for specific industries

- Transparent and competitive pricing

- Easy certificate of insurance generation

Next Insurance focuses on simplifying insurance for small businesses across various industries. Their digital-first approach has revolutionized how small business owners access and manage their insurance policies. With its user-friendly interface and tailored coverage options, Next Insurance has rapidly expanded its presence across the United States.

3. Hippo: Proactive Home Protection

- Key Features:

- Smart home monitoring devices provided free with policies

- Proactive alerts to prevent damage before it occurs

- Streamlined digital experience for policy management

Hippo is reimagining home insurance for the modern homeowner. By focusing on proactive protection and coverage that aligns with contemporary needs, Hippo has quickly gained traction in the US market. Hippo’s forward-thinking approach to home protection sets it apart in the competitive insurance landscape.

4. VOOM: On-Demand Insurance for High-Risk Vehicles

- Key Features:

- Pay-per-use model for flexible coverage

- Specialized policies for emerging mobility solutions

- AI-driven risk assessment for accurate pricing

- User-friendly mobile app for policy management

VOOM has carved out a unique niche in the insurance market by offering usage-based insurance for high-risk vehicles such as drones, motorcycles, and e-scooters. VOOM’s innovative approach addresses the evolving needs of the sharing economy and new mobility trends.

5. Faye Insurance: Redefining Travel Protection for the Modern Traveler

- Key Features:

- Pet travel coverage, a unique add-on for pet-owning travelers

- Proactive alerts to prevent damage before it occurs

- 24/7 support and instant claims processing through the Faye app

- Cash refunds and expense reimbursements in real-time

Faye Insurance combines comprehensive travel coverage with a user-friendly, app-based experience, offering peace of mind for travelers on the go. With its digital-first approach, Faye Insurance is revolutionizing travel insurance, making it easier and faster for travelers to get protected and access funds when they need it most.

The Future of Insurtech: Israeli Innovation Leads the Way

As these Israeli insurtech companies continue to innovate and expand their presence in the US market, we can expect to see even more transformative changes in the insurance industry. From AI-driven underwriting to blockchain-based smart contracts, the potential for further disruption is immense.

Emerging Trends to Watch in Israeli Insurtech

- Increased Personalization: Leveraging big data for hyper-personalized policies

- IoT Integration: Using connected devices for real-time risk assessment

- Blockchain Adoption: Enhancing security and transparency in insurance transactions

- Embedded Insurance: Seamlessly integrating insurance into other products and services

Conclusion: Israeli Insurtech Reshaping the US Insurance Landscape

The success of Israeli insurtech companies in the US market demonstrates the power of combining technological innovation with industry-specific expertise. As these companies continue to grow and evolve, they are not just changing the face of insurance – they’re creating a more accessible, efficient, and customer-centric industry for the digital age.

By addressing long-standing issues in the US insurance market, such as complex processes, lack of personalization, and outdated systems, Israeli insurtech firms are setting new standards for the global insurance industry.

Want to stay updated on the latest insurtech innovations? [Subscribe to our newsletter](#) for exclusive insights and analysis.

Subscribe Today. Empower Israeli Businesses.

Israeli insurtech companies have emerged as global leaders in insurance innovation, making significant waves in the United States market. These Israel-based insurance technology firms are leveraging cutting-edge technologies like artificial intelligence (AI), big data analytics, and user-friendly digital platforms to revolutionize the traditional insurance landscape.

The Rise of Israeli Insurtech in the USA: Innovation Meets Opportunity

Israel, often dubbed the “Startup Nation,” has become a hotbed for technological advancement in various sectors, including insurance. The combination of a strong entrepreneurial spirit, advanced technological expertise, and a problem-solving mindset has positioned Israeli insurtech companies at the forefront of innovation.

Why Israeli Insurtech is Thriving

- Innovative Approaches: Israeli companies excel in applying AI, machine learning, and big data to create scalable insurance solutions.

- Agile Development: The startup culture in Israel fosters rapid iteration and adaptation to market needs.

- Market Opportunity: The US insurance industry, with its size and need for modernization, provides an ideal testing ground for innovative insurtech solutions.

Top 5 Israeli Insurtech Companies Making an Impact in the US Market

1. Lemonade: Revolutionizing Home and Renters Insurance

- Key Features:

- Lightning-fast 90-second sign-up process

- Transparent pricing model

- Social impact focus with leftover premiums donated to charities

Lemonade has disrupted the traditional insurance model since its launch in 2016. This AI-driven insurtech company has reimagined the insurance experience from the ground up. Lemonade’s innovative approach has earned it a loyal customer base and a successful IPO in 2020, marking a significant milestone for the insurtech industry.

2. Next Insurance: Tailored Solutions for Small Businesses

- Key Features:

- Fully digital platform for instant quotes and policy management

- Customized insurance packages for specific industries

- Transparent and competitive pricing

- Easy certificate of insurance generation

Next Insurance focuses on simplifying insurance for small businesses across various industries. Their digital-first approach has revolutionized how small business owners access and manage their insurance policies. With its user-friendly interface and tailored coverage options, Next Insurance has rapidly expanded its presence across the United States.

3. Hippo: Proactive Home Protection

- Key Features:

- Smart home monitoring devices provided free with policies

- Proactive alerts to prevent damage before it occurs

- Streamlined digital experience for policy management

Hippo is reimagining home insurance for the modern homeowner. By focusing on proactive protection and coverage that aligns with contemporary needs, Hippo has quickly gained traction in the US market. Hippo’s forward-thinking approach to home protection sets it apart in the competitive insurance landscape.

4. VOOM: On-Demand Insurance for High-Risk Vehicles

- Key Features:

- Pay-per-use model for flexible coverage

- Specialized policies for emerging mobility solutions

- AI-driven risk assessment for accurate pricing

- User-friendly mobile app for policy management

VOOM has carved out a unique niche in the insurance market by offering usage-based insurance for high-risk vehicles such as drones, motorcycles, and e-scooters. VOOM’s innovative approach addresses the evolving needs of the sharing economy and new mobility trends.

5. Faye Insurance: Redefining Travel Protection for the Modern Traveler

- Key Features:

- Pet travel coverage, a unique add-on for pet-owning travelers

- Proactive alerts to prevent damage before it occurs

- 24/7 support and instant claims processing through the Faye app

- Cash refunds and expense reimbursements in real-time

Faye Insurance combines comprehensive travel coverage with a user-friendly, app-based experience, offering peace of mind for travelers on the go. With its digital-first approach, Faye Insurance is revolutionizing travel insurance, making it easier and faster for travelers to get protected and access funds when they need it most.

The Future of Insurtech: Israeli Innovation Leads the Way

As these Israeli insurtech companies continue to innovate and expand their presence in the US market, we can expect to see even more transformative changes in the insurance industry. From AI-driven underwriting to blockchain-based smart contracts, the potential for further disruption is immense.

Emerging Trends to Watch in Israeli Insurtech

- Increased Personalization: Leveraging big data for hyper-personalized policies

- IoT Integration: Using connected devices for real-time risk assessment

- Blockchain Adoption: Enhancing security and transparency in insurance transactions

- Embedded Insurance: Seamlessly integrating insurance into other products and services

Conclusion: Israeli Insurtech Reshaping the US Insurance Landscape

The success of Israeli insurtech companies in the US market demonstrates the power of combining technological innovation with industry-specific expertise. As these companies continue to grow and evolve, they are not just changing the face of insurance – they’re creating a more accessible, efficient, and customer-centric industry for the digital age.

By addressing long-standing issues in the US insurance market, such as complex processes, lack of personalization, and outdated systems, Israeli insurtech firms are setting new standards for the global insurance industry.

Want to stay updated on the latest insurtech innovations? [Subscribe to our newsletter](#) for exclusive insights and analysis.